This Document is to confirm our understanding of the terms of our engagement and the nature and limitations of the services we will provide.

This firm will provide lodgement Individual Income Tax Return services which will be conducted in accordance with the relevant professional and ethical standards issued by the Accounting Professional & Ethical Standards Board Limited (APESB). The extent of our procedures will be limited exclusively for this purpose. As a result, no audit or review will be performed and, accordingly, no assurance will be expressed. Our engagement cannot be relied upon to disclose irregularities including fraud, other illegal acts and errors that may exist. However, we will inform you of any such matters that come to our attention. The engagement will include the operations and procedures of the Client as agreed

Our professional services are conducted and the Individual Income Tax Return will be prepared for distribution to the relevant specific organisation or party for the purpose specified in the report or as agreed. We disclaim any assumption of responsibility for any reliance on our professional services to any party other than as specified or agreed, and for the purpose which it was prepared. Where appropriate, our report will contain a disclaimer to this effect.

In conducting this engagement, information acquired by us in the course of the engagement is subject to strict confidentiality requirements. That information will not be disclosed by us to other parties except as required or allowed for by law, or with your express consent.

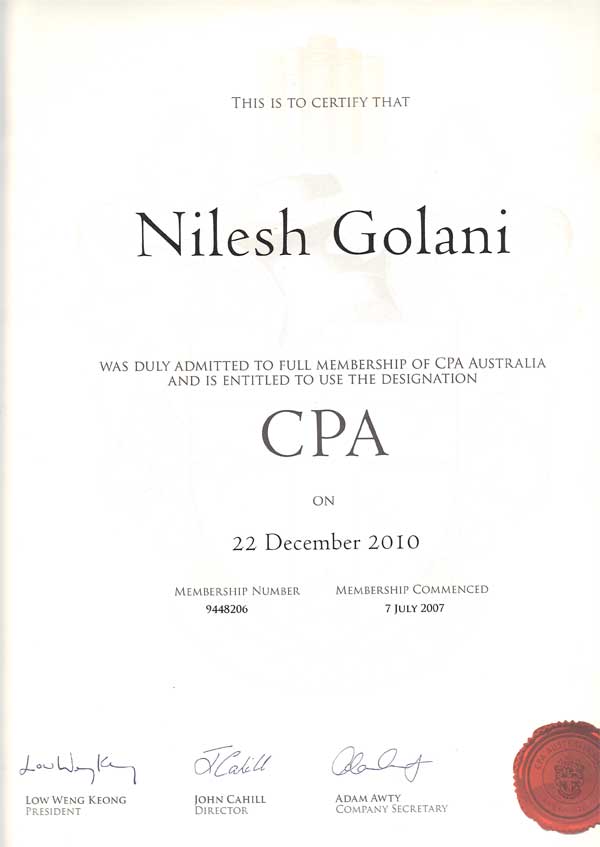

We wish to advise that our firm’s system of quality control has been established and maintained in accordance with the relevant APESB standard. As a result, our files may be subject to review as part of the quality control review program of CPA Australia which monitors compliance with professional standards by its members. We advise you that by accepting our engagement you acknowledge that, if requested, our files relating to this engagement will be made available under this program. Should this occur, we will advise you.

Clients are responsible for the reliability, accuracy and completeness of the accounting records, particulars and information provided and disclosure of all material and relevant information. Clients are required to arrange for reasonable access by us to relevant individuals and documents, and shall be responsible for both the completeness and accuracy of the information supplied to us. Any advice given to the Client is only an opinion based on our knowledge of the Client’s particular circumstances.

A taxpayer is responsible under self assessment to keep full and proper records in order to facilitate the preparation of a correct return. Whilst the Commissioner of Taxation will accept claims made by a taxpayer in an income tax return and issue a notice of assessment, usually without adjustment, the return may be subject to later review. Under the taxation law such a review may take place within a period of up to 7 years after tax becomes due and payable under the assessment. Furthermore, where there is fraud or evasion there is no time limit on amending the assessment. Accordingly, you should check the return before it is signed to ensure that the information in the return is accurate.

Where the application of a taxation law to your particular circumstances is uncertain you also have the right to request a private ruling which will set out the Commissioner’s opinion about the way a taxation law applies, or would apply, to you in those circumstances. You must provide a description of all of the facts (with supporting documentation) that are relevant to your scheme or circumstances in your private ruling application. If there is any material difference between the facts set out in the ruling and what you actually do the private ruling is ineffective.

you rely on a private ruling you have received, the Commissioner must administer the law in the way set out in the ruling, unless it is found to be incorrect and applying the law correctly would lead to a better outcome for you. Where you disagree with the decision in the private ruling, or the Commissioner fails to issue such a ruling, you can lodge an objection against the ruling if it relates to income tax, fuel tax credit or fringe benefits tax. Your time limits in lodging an objection will depend on whether you are issued an assessment for the matter (or period) covered by the private ruling.

This engagement will start upon acceptance of the terms of engagement by the Client in line with this brochure. We will not deal with earlier periods unless the Client specifically asks us to do so and we agree.

The fee arrangement is based on the expected amount of time and the level of staff required to complete the Individual Income Tax Return services as agreed. This fee arrangement may be subject to change their is Involvement of complex transactions including Investment property and Capital Gains Transactions. Fee invoices will be issued in line with a billing schedule advised to the Client.

Our liability is limited by a scheme approved under Professional Standards Legislation. Further information on the scheme is available from the Professional Standards Councils’ website: http://www.professionalstandardscouncil.gov.au.

Where, as part of our engagement, the services of an external consultant or expert are required, an estimated cost and timeframe and involvement will be provided to you for your approval.

We do have Outsourcing arrangements with a professional accounting firm in India whom we hire from time to time to help us in the busy period. Acceptance of our services in conjunction with this engagement document indicates your acceptance of the use of outsourced services as described. Where the outsourced service requires the disclosure of personal information to an overseas recipient a consequence of your consent is that Aplus Tax Solution will be required to take reasonable steps to ensure that the Australian Privacy Principles are complied with by the overseas recipients of the Personal Information.

By signing this letter and accepting these services you acknowledge and agree that your personal information may be stored overseas.

All original documents obtained from the client arising from the engagement shall remain the property of the client. However, we reserve the right to make a reasonable number of copies of the original documents for our records. Our engagement will result in the production of Individual Income Tax Returns Ownership of these documents will vest in you. All other documents produced by us in respect of this engagement will remain the property of the firm. The firm has a policy of exploring a legal right of lien over any client documents in our possession in the event of a dispute. The firm has also established dispute resolution processes.

Any information acquired by us in the course of our engagement is subject to strict confidentiality requirements. Information will not be disclosed by us to other parties except as required or allowed for by law or professional standards, or to our subcontractors whom we hire from time to time to help us in the busy period. Our files may, however, be subject to review as part of the quality control review program of CPA Australia which monitors compliance with professional standards by its members. We advise you that by signing this letter you acknowledge that, if requested, our files relating to this engagement will be made available under this program. Should this occur, we will advise you. The same strict confidentiality requirements apply under this program as apply to us.

In relation to any subsequent termination of our services, you are advised that we shall be entitled to retain all documents belonging to you and any related parties we act for until payment is received in full for all outstanding fees.

Acceptance of our services in conjunction with this information brochure indicates that you understand and accept the arrangements. This information will be effective for future engagements unless we advise you of any change.

Medical Practices

Medical Practices Legal Practices

Legal Practices Wholesale

Wholesale Childcare Services

Childcare Services Hospitality

Hospitality Construction

Construction Real Estate Agents

Real Estate Agents International Traders

International Traders Information Technology (IT)

Information Technology (IT)